A Tale of Two Stock Markets - Listed Companies in Constant Decline!

There has been a lot of talk of late about the US stock market and liquidity in those markets for IPOs under $400 million in valuation.

A lot of people are starting to state that if you go public under $400 million in valuation you simply won’t be able to get the liquidity needed for your IPO to be a success and your stock price will naturally drop if you are below this amount.

I’m sure there is a lot of research being done on this at present, but I have yet to see anything conclusive.

However, there seems to be some interesting trends just purely around the number of IPOs on each market around the world and here are the facts.

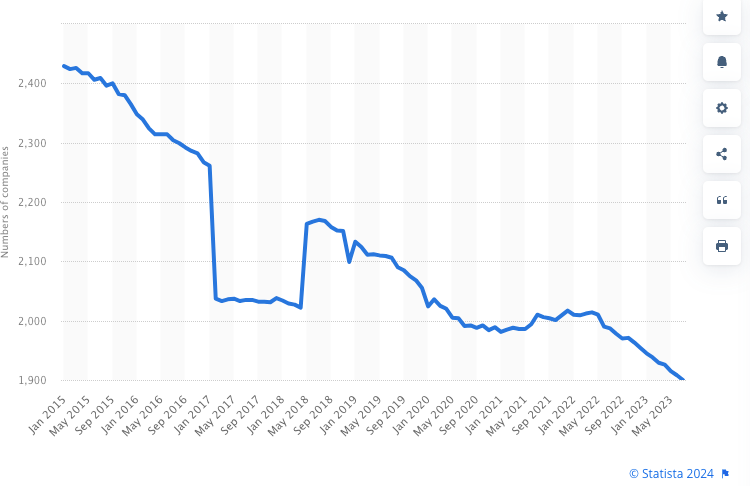

London Stock Exchange:

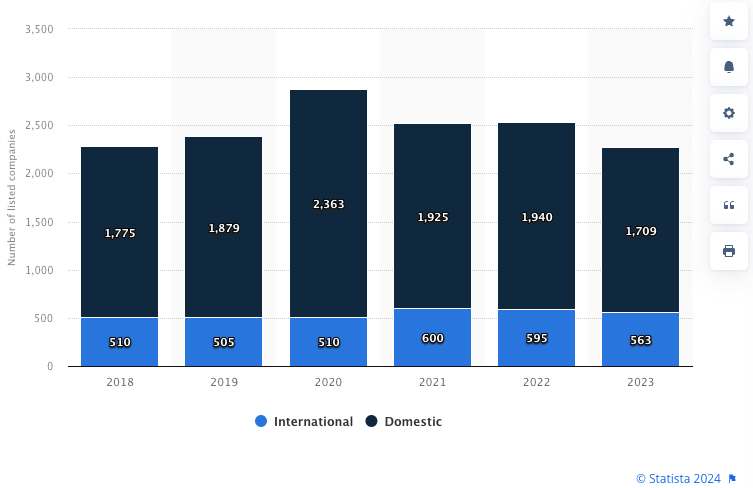

NYSE:

There are a lot of issues to unpack on why there is a continual drop in listed companies both in the US and the UK, but the facts remain.

Is this also related to the rise of Private Equity? Are the largest companies making more and more acquisitions?

Time will tell on whether these trends continue, but I think at the heart of capitalism is a strong equity market!